Affirm Financing - Buy Now, Pay later

Affirm is the smartest way to pay over time. Shop for all the gear you love and pay at your own pace without any fees, so you can get the things you love without breaking your budget.

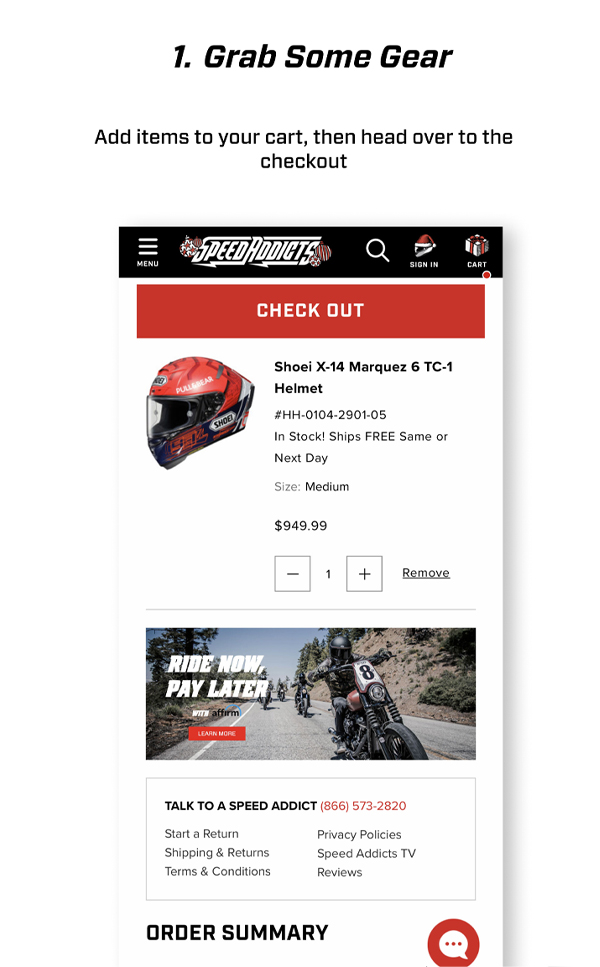

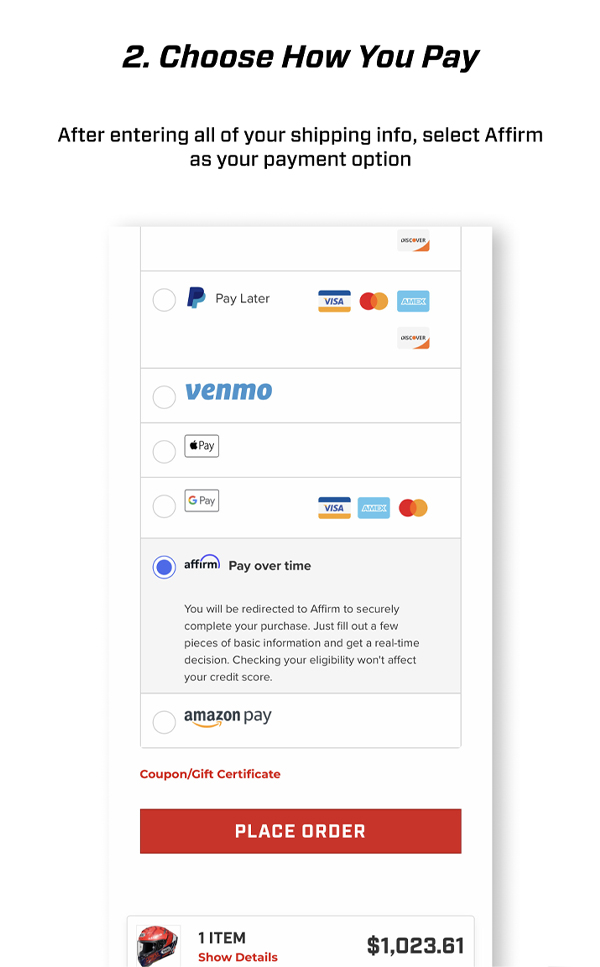

How to buy with Affirm

- Go Shopping Shop your favorite gear and at checkout select Affirm as your payment option. You’ll see us at checkout

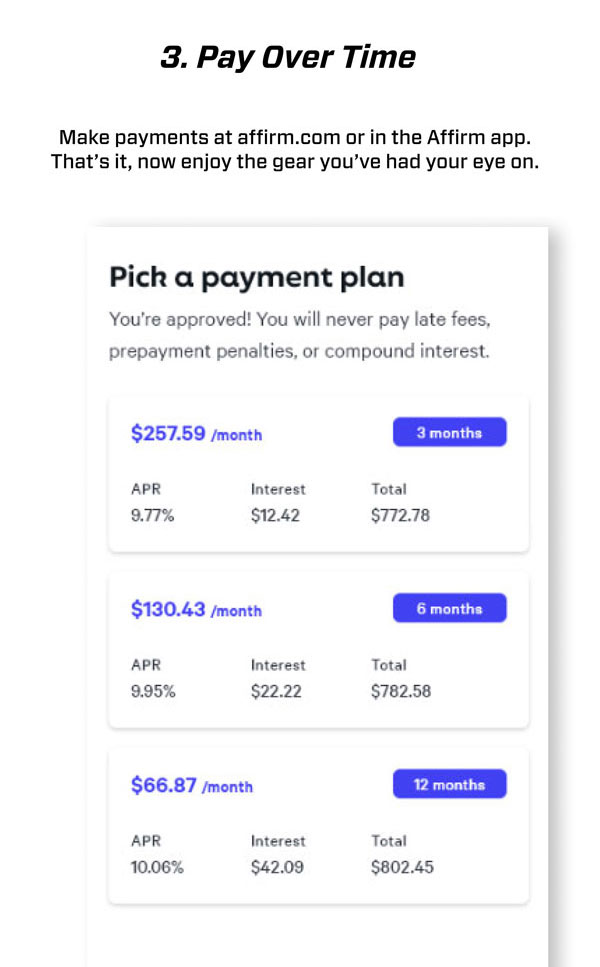

- Choose your payment terms Pick the payment option that works for you and your budget—from 4 interest-free payments every 2 weeks to monthly installments.

- Make your payments Manage your payments in the Affirm app or online, and set up AutoPay so you don’t miss a payment. But if you do, you’ll never pay any fees.

FAQ

Will Affirm affect my credit score?

Creating an Affirm account and seeing if you prequalify will not affect your credit score. If you decide to buy with Affirm, these things may affect your credit score: making a purchase with Affirm, your payment history with Affirm, how much credit you've used, and how long you’ve had credit.

Does Affirm charge interest and fees?

Affirm doesn't charge any fees. That means no late fees, no prepayment fees, no annual fees, and no fees to open or close your account. Depending on the size of your purchase and where you’re shopping, your payment plan may include interest. You’ll never owe more interest than you agree to on day one—so you always know exactly what you’re getting into.

What does it mean to prequalify?

When you prequalify, you get an estimate of how much you can spend with Affirm. You don’t have to use the full amount, and you’re not on the hook to pay anything back until you actually make a purchase.

Rates from 0% APR or 10-36% APR. Payment options through Affirm are subject to an eligibility check, may not be available in all states, and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license.